by Micheal E. McKinnon, M.Ed., CCPS; College Planners of America, Ltd | Jan 22, 2024 | College Savings Plans

According to the College Tuition and Fees price index maintained by the U.S. Bureau of Labor Statistics, the cost of tuition was 1,490% higher in 2023 than it was in1977. Between 1977 and 2023, tuition — the largest component in the cost of attending college —...

by Micheal E. McKinnon, M.Ed., CCPS; College Planners of America, Ltd | Jan 8, 2024 | Financial Aid

One reason for the establishment of the U.S. Education Department (ED) in 1979 was to assist students in paying for a post-secondary education. Like corporations that market to consumers, the ED conducts much of its business with its student-consumers over the...

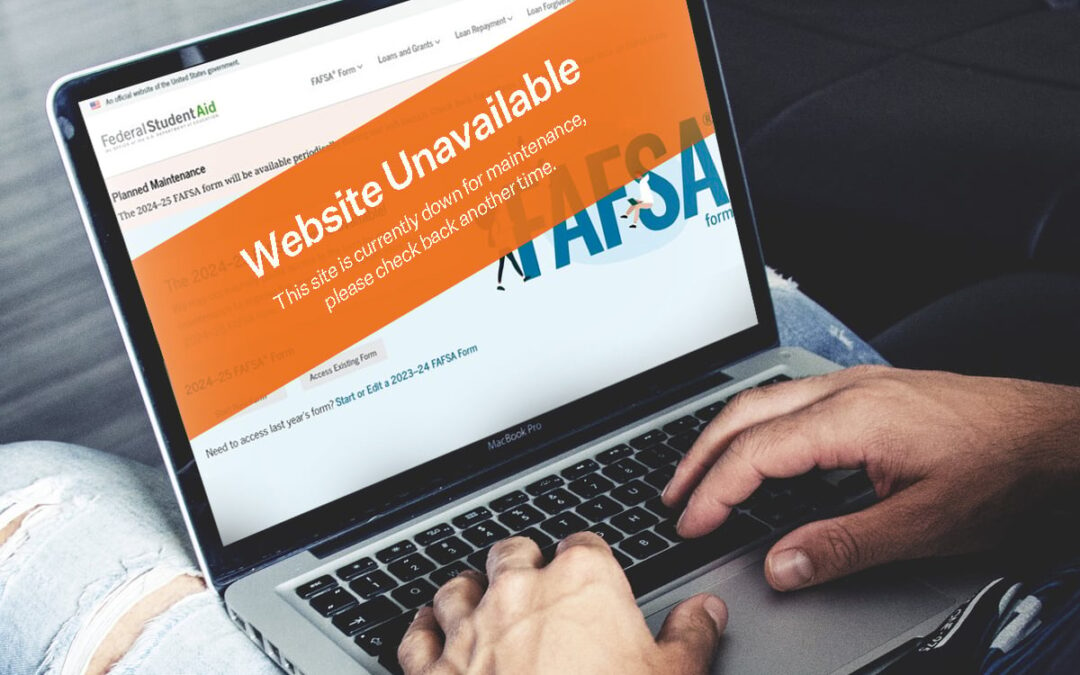

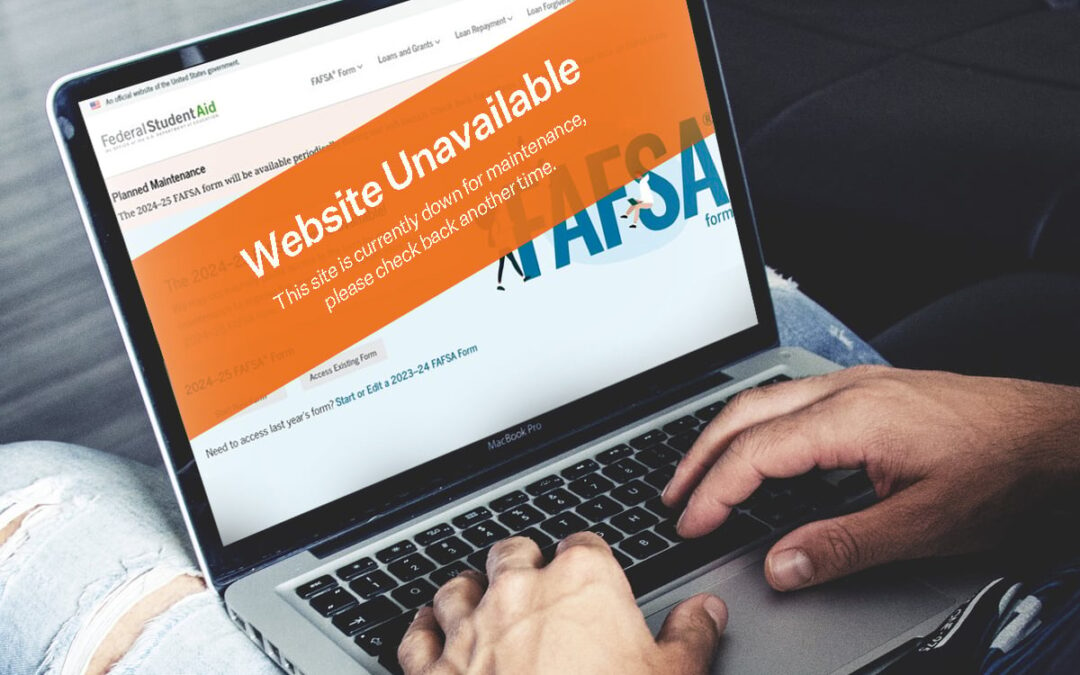

by Micheal E. McKinnon, M.Ed., CCPS; College Planners of America, Ltd | Jan 3, 2024 | FAFSA

The 2024–25 Free Application for Federal Student Aid (FAFSA) is now available through a soft launch by the Federal Student Aid (FSA) office of the U.S. Education Department (ED). It is online at Studentaid.gov and Fafsa.gov. The FSA released the following announcement...

by Micheal E. McKinnon, M.Ed., CCPS; College Planners of America, Ltd | Dec 27, 2023 | Exams

The College Level Examination Program (CLEP) may be the best deal in American post-secondary education. Non-traditional students such as those who didn’t go on to college directly after high school and now work full-time can earn college credits without taking college...

by Micheal E. McKinnon, M.Ed., CCPS; College Planners of America, Ltd | Dec 20, 2023 | FAFSA

Submission of the Free Application for Federal Student Aid (FAFSA) is an essential step for all students seeking Federal, state, institutional, and private financial aid. To improve the financial aid process, the FAFSA Simplification Act was enacted by Congress on...

Recent Comments