by Micheal E. McKinnon, M.Ed., CCPS; College Planners of America, Ltd | Aug 16, 2022 | Uncategorized

According to the U.S. Department of Commerce, the cost of college tuition is 1,447% higher in 2022 than it was in 1977. During that time, tuition has experienced an average inflation rate of 6.28% per year, so a college charging $20,000 for four years of tuition in...

by Micheal E. McKinnon, M.Ed., CCPS; College Planners of America, Ltd | Aug 8, 2022 | Tax Planning

Gifts of Business Interest In previous posts, we covered methods of deferring investments in the equity markets such as Qualified Tuition Plans (529 Plans). However, a better strategy is to defer all of the child’s income taxes to their college years. There are...

by Micheal E. McKinnon, M.Ed., CCPS; College Planners of America, Ltd | Aug 2, 2022 | Tax Planning

Careful college and tax planning through a divorce transition can result in the preservation of more of the income and assets of both parents and their children. The preserved income and assets can be used to fund future college costs of the children. Property...

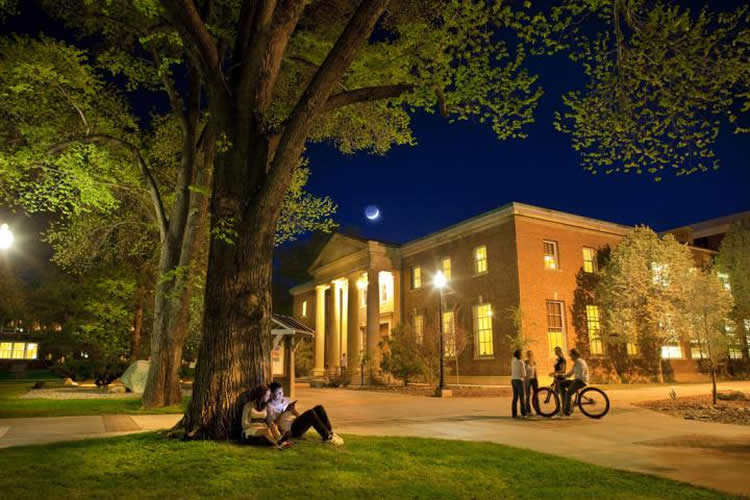

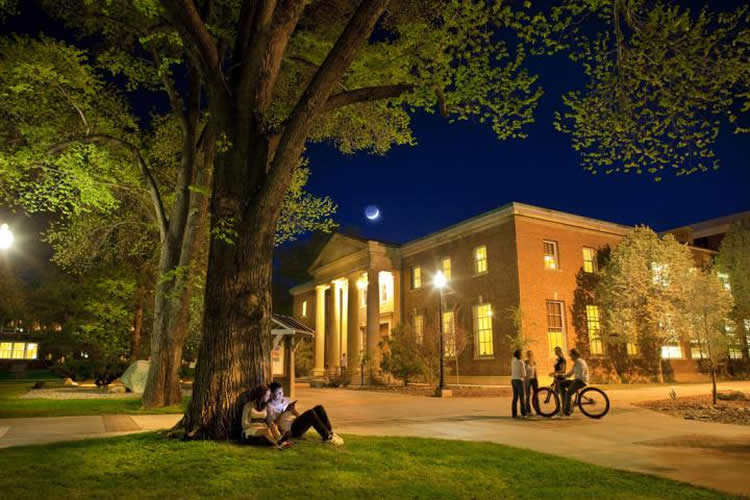

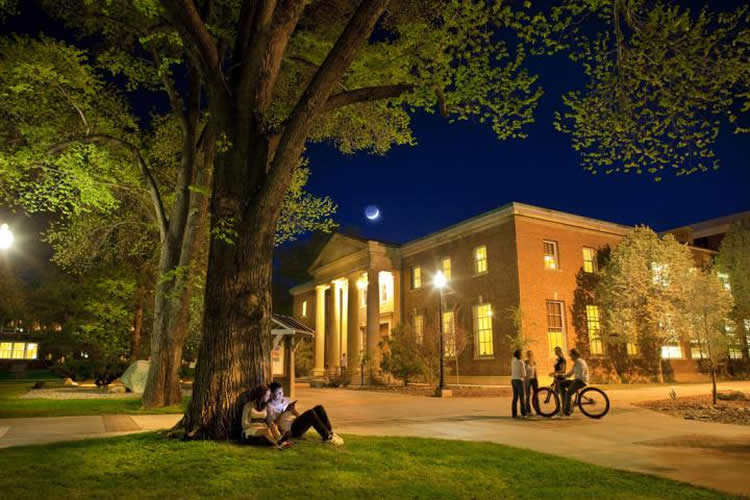

by Micheal E. McKinnon, M.Ed., CCPS; College Planners of America, Ltd | Jul 25, 2022 | Colleges

The traditional image of college education features students in a classroom with a professor lecturing them. But lately, more and more students are opting to take college courses online from home. Instead of a classroom, students engage with their coursework,...

by Micheal E. McKinnon, M.Ed., CCPS; College Planners of America, Ltd | Jul 17, 2022 | Exams

The College Level Examination Program (CLEP) is the most widely accepted college credit-by-examination program in the United States. While Advanced Placement (AP) courses are usually taken by above-average students, CLEP exams benefit average and non-traditional,...

Recent Comments