by Micheal E. McKinnon, M.Ed., CCPS; College Planners of America, Ltd | May 19, 2025 | Financial Aid

Federal Direct Loans are government-backed financial aid options provided by the U.S. Education Department (ED) to help students afford the costs of higher education. Direct Subsidized Loans offer an initial interest-free period during college years for eligible...

by Micheal E. McKinnon, M.Ed., CCPS; College Planners of America, Ltd | May 7, 2025 | Federal Student Loans

A Parent PLUS Loan (PPL) is a Federal student loan program that helps parents finance their dependent children’s college education, making it a vital resource for families facing rising college costs. Carrying a fixed interest rate of 9.08% for both the 2024-25...

by Micheal E. McKinnon, M.Ed., CCPS; College Planners of America, Ltd | May 1, 2025 | Federal Student Loans

Private student loans are financial products offered by private lenders to help students finance their college education. They are distinct from Federal student loans provided by the government. Private loans have the potential to fill funding gaps when Federal...

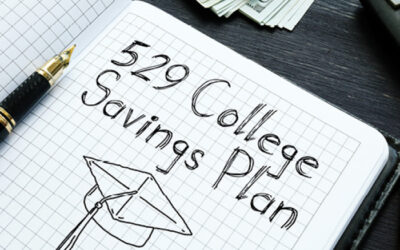

by Micheal E. McKinnon, M.Ed., CCPS; College Planners of America, Ltd | Apr 29, 2025 | Tax Planning, Uncategorized

When surveyed by The College Investor (TCI), 75% of parents with college-bound children said that they are currently saving for their child’s college education. TCI also found that over 80% of parents are concerned about the impact of inflation on college savings. The...

by Micheal E. McKinnon, M.Ed., CCPS; College Planners of America, Ltd | Apr 28, 2025 | Federal Student Loans

A student loan borrower may be contacted by the marketing arm of a Federal student loan service provider for the Education Department (ED) at any time during the term of the loan. The borrower will be asked to transfer their accounts to that provider in exchange for...

Recent Comments