by Micheal E. McKinnon, M.Ed., CCPS; College Planners of America, Ltd | Sep 11, 2025 | Admissions Tips

A high school senior’s College List is a key element in the success of their college admissions campaign. It is the set of colleges to which the student plans to apply over the next few months. They are colleges that that student determine are exceptionally...

by Micheal E. McKinnon, M.Ed., CCPS; College Planners of America, Ltd | Aug 26, 2025 | Admissions Tips

A high school senior’s College List is a key element in the success of their college admissions campaign. It is the set of colleges to which the student plans to apply over the next few months. They are colleges that that student determine are exceptionally...

by Micheal E. McKinnon, M.Ed., CCPS; College Planners of America, Ltd | Aug 22, 2025 | College Savings Plans

Among educational savings plans, 529 accounts are the most widely used and popular option. There are about 17 million 529 accounts currently valued at over $525 billion. For years, 529 accounts have been considered to be educational savings plans intended for college...

by Micheal E. McKinnon, M.Ed., CCPS; College Planners of America, Ltd | Aug 19, 2025 | Federal Student Loans

The Affordable Loans for Students Act (the Act) was introduced in Congress on March 10 as an amendment to the Higher Education Act (HEA) of 1965 for the purpose of lowering Federal student loan interest rates to 2%. The rate reduction will apply to all borrowers,...

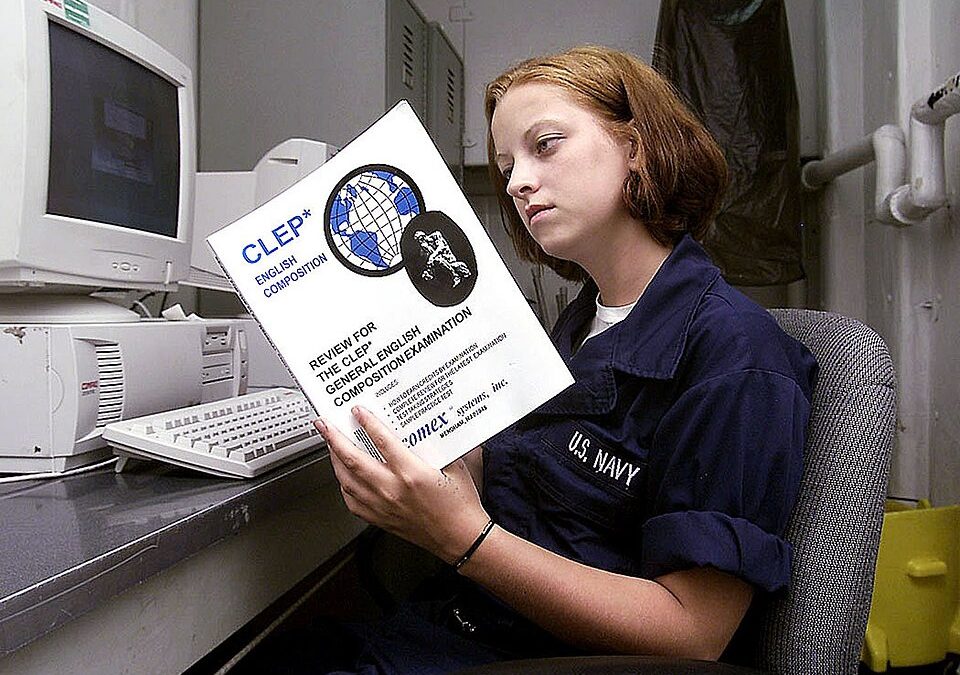

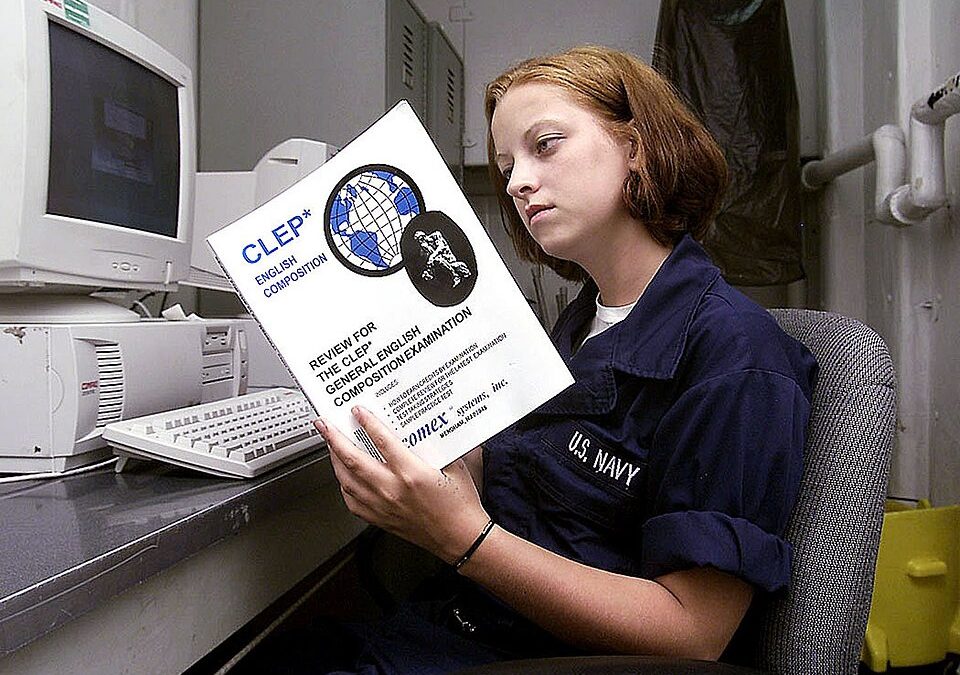

by Micheal E. McKinnon, M.Ed., CCPS; College Planners of America, Ltd | Jul 25, 2025 | Exams

The College-Level Exam Program (CLEP) may be the best deal in American post-secondary education. People who didn’t go to college directly after high school as well as other non-traditional students working full-time can earn credits at a college without taking courses...

Recent Comments